Merrymeeting Daylilies

Cathy and Amanda Turner

603-534-1371

80 Tash Road

New Durham, NH, 03855

MerrymeetingDaylilies@gmail.com

A man (Les Turner) "out standing" in his field...

Les Turner, battling those dratted weeds...with his back brace doing it's best to help the broken bones in his spine.

We, his daughters, can only be glad that at least he has his hat on.

This picture was taken May 20, 2020, the day before his 87th birthday.

Amanda and I have decided that it is time to inform our friends, neighbors, and customers about the biggest reason that we decided not to open Merrymeeting Daylilies for 2023 and 2024. I have been reluctant to mention anything here because we were raised to not "air our dirty laundry in public". But this situation is not OUR dirty laundry.

WE did nothing wrong.

We did not open last summer largely because we have been forced into a humiliating battle for our house and land, thru no fault of our own. We have been living in a legal quagmire that has cost both of us greatly in stress, time, and money. We are possibly going to lose our home...as well as all of the hard work that we, and our parents and siblings, have put into this property over the last 28 years.

Why? Because a certain Big International Bank made a clerical error, corrected it illegally, could not be bothered to communicate with our father (or the NH Court system) about that correction, and did not appear as summoned for THREE court hearings…

and then waited silently for FIVE YEARS to take action.

Les's hands, and adult plants of two very different varieties of hosta.

Would you like the details? Certainly. Here they come.

Many people know that something is going on. We theorize that quite a few drove by while the FORECLOSURE AUCTION was in full swing in our front yard in May of 2023. Yes, a foreclosure auction. I hope you never have to live thru something like that. It was bad. Demeaning, embarrassing, shameful. And a terrible surprise. And this is a small town, and we are on the road to the town dump.

Lots of town people had to ease around all those parked cars.

No doubt about what was happening. And it was advertised on the Internet, too.

Since then, my sister and I have been approached by people in Hannaford’s, or at the dump, even at the New Durham Store. These kind and caring people are concerned that we have lost our home…or are close to it. They knew our parents, or they know us. We appreciate their concern. We ARE very much in danger of losing our home, and the daylily field. I am referring to the house and land at 80 Tash Road, in New Durham, originally purchased and occupied by our parents. Many people remember our mother, Nathalie Turner, as she was a much loved art teacher at the high school in Farmington for many years. Other people remember our father, Leslie Turner. If you are here on this website, you probably knew him as a fellow gardener, an educator, a writer for a local paper, a man with a strong work ethic and a life-long love for daylilies.

Our parents lived on Brackett Road for several years, and then purchased the property at 80 Tash Road in May of 1996, as both a home and as a business. They were both raised during the Great Depression, and they worked hard and lived frugally in order to pay off the mortgage as quickly as possible. I am uncertain of the exact date, but I believe it was right around 2005 that the mortgage was paid off.

The following year, on Nov. 8, 2006, an equity loan was opened with “The Big Bank” at their branch in Alton. Why am I not naming this bank? Because they have us thoroughly scared. There is a saying… “It is not libel if it is true”, but for now I am not going to include their name here. The equity loan was always in good standing.

Ten years later, in 2016, Les discovered that there was an error in the paperwork for the mortgage.

He contacted the bank and asked them to correct it. They ignored him.

Let me repeat that...the BANK made a mistake in the paperwork and Les asked them to fix it. They did not respond.

In February of 2017, he sought legal help from a law firm in Alton, because the Bank was apparently going to continue ignoring him. A hearing was scheduled in early May, 2017. The Bank was fully and legally notified of this hearing…and they failed to appear. The judge was not happy. And Les was paying an expensive attorney and paying for legal filings, and notifications, etc. as well as spending time in a court room while his daylily customers faced a “Sorry, Closed Today” sign at his business.

But the judge decided it would be only fair to reschedule everything and try again in 30 days. Les paid his lawyer to notify the Bank, set up another hearing, join him in the court room…and you guessed it…the Bank failed to appear AGAIN. To make this ridiculous story a wee bit shorter, but no less expensive and frustrating for Les…this happened yet again (June 29, 2017), for a total of three attempted hearings, 30 days apart.

(While declaring the need for a THIRD hearing, the judge used the phrase “out of an abundance of caution”.

This became a semi-funny sarcastic catch phrase around our family for a while.)

But at the third hearing, the judge, who had had his time wasted by the Bank one time too many, not only fixed the mistake, but also said something which Les’s lawyer understood as discharging the remaining balance on the loan. This was a punitive action for wasting the Court’s time and not showing up, as the Bank was required BY LAW to do. Dad was surprised and a bit unsure, as we all were, when he told us about it over Sunday dinner.

But his lawyer said it was real, and Les discontinued making payments.

A few months later, the Bank sent a single form letter to Les to ask why he had stopped making payments on the loan. Les contacted his lawyer, and the lawyer wrote a letter to the Bank informing them of the Court’s decision. The lawyer told Les to hold on to a copy of that letter, as he suspected that the Bank would “pop up from time to time” and press for payment. (My sister and I refer to it as “The Lawyer’s Letter”.) Les put that letter front and center in his filing cabinet…but he never heard from the Bank again.

Les lived 3 more years, with never another word or notice from them.

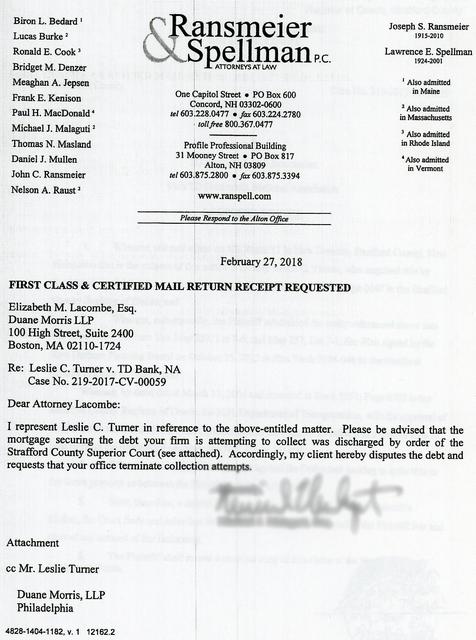

This is "The Lawyer's Letter". I am blurring out the name of the lawyer as he is no longer an attorney. He might not appreciate me putting his name here, and as one who has recently been humiliated online, I will respect that.

I am also not displaying the name of the bank. In this case, I know they have a much bigger budget for legal expenses than we do...

I am only putting this letter here so that you can understand why Les believed that this loan had been discharged. He was not evading a debt or being difficult. He truly believed that it was a dead issue.

As some of you may know, our father passed away in October of 2020. I was (and am) the designated executor of his Will. In February of 2021, (4 months after he passed) I received a letter from the Bank demanding payment in full on the loan or they would put the house and land to auction. We were given a whole month to pack up everything and get out. The letter was addressed to me, as executor, so they knew that Les had passed. I sent them a copy of “The Lawyers Letter”, and they never replied.

TWO YEARS GO BY.

The Will has been probated, his estate settled, and the remaining cash has been distributed as his Will directed. The house and land were put into a Trust that Les set up in 2019 to insure that my sister will have a safe place to live for the remainder of her life. Amanda took excellent care of both of our parents during their final years, and she is disabled, so he wanted to be sure she would be ok.

I am the Trustee of the Trust, and I had promised my parents that I would take care of the house and Amanda.

And I am trying to do exactly that.

On Jan. 27, 2023, I received a letter from the Bank stating that an auction to sell our house has been scheduled for the following month. I sent them another copy of “The Lawyer’s Letter”, and thought no more of it. But THIS time I heard back from them with a confirmation of the scheduled sale. In a panic, I turned everything over to the attorney who had been handling the Will and Trust. I had never mentioned the Bank loan situation to him, because I thought it was long settled and a dead issue. Our lawyer looked into the situation and discovered that there was some possible uncertainty in the way that the court decree had been worded FIVE YEARS BEFORE. The legalese is confusing to us, but our lawyer has noted that it is not crystal clear that the debt had been discharged.

You can imagine my dismay.

Why did the Big Bank wait FIVE YEARS to get serious about this issue?

There is a legal concept called “timely effort”, which requires a creditor to make regular attempts to have a debtor pay on a debt. They sent one form letter and then NOTHING to our father for more than THREE YEARS. If they had scheduled an auction while our father was alive, he would have dealt with it, legally or financially, and with vigor.

The Bank sent me ONE letter, as executor, and then they were silent for TWO MORE YEARS.

Two letters in five years does not seem like “timely effort”, at all.

And then "The Bank" suddenly reappeared.

When our lawyer informed the Bank that we would be fighting for our house, the foreclosure auction was postponed from March to May 24, 2023. Our lawyer was able to get a hearing scheduled for May 4, 2023, which was 20 days BEFORE the scheduled auction. The hearing was held, (and a lawyer for the Bank actually showed up!) but a decision was NOT made at the hearing. Apparently, this is normal, and the judge will make his ruling when he has had enough time to go over the paperwork and the information presented at the hearing.

In fact, as I am writing this in February of 2024 the decision has STILL not been made. Yup, nine months of living with the fear of losing our family home, hanging over my head. My sister and I can barely talk about it at this point.

With a decision pending, one would think that the auction of our home would be postponed, and stay postponed, until a result came from the Court. Right? Sensible? No.

The auction went ahead, full steam.

I was out of state, and Amanda was home, sick in bed. And suddenly there was an auctioneer in our front yard, with a table, and banners, and a loud speaker with a microphone. Total strangers were parked higgledy-piggledy all over the lawn and road and people were opening gates, and walking up both sides of the house, pointing at things and taking pictures. Amanda called me, sobbing, and then (in a panic) called the New Durham police for help. She was ill, medicated, and had no idea what was happening. Chief Bernier arrived quickly, and did the best he could for crowd control. He chased parked cars out of the road, as well. I was frantically calling our lawyer, but it was too little, too late.

The auctioneer sold our house for $95K.

That is less than a third of its value from the last time the property was appraised. I rushed all the way home, but it took me two hours to get back. Nothing was left from the auction but tire tracks on our lawn….and a deep feeling of shame dropped on to both Amanda and me. A foreclosure auction…advertised far and wide, had been held on our front lawn.

My face is red just typing those words out.

Our lawyer said holding the auction while a decision was pending was “highly unethical, but legal”. He did inform the judge, and the judge had some very harsh words for the Bank, but the Bank is continuing to threaten us with the buyer, who is ready to take possession if the court decides against us.

So there it is. We did not open for business this year because we might be told to get out at any moment. We live in a state of anxiety every day, awaiting the call from our attorney. I am afraid to look at my email. Amanda can’t bring herself to rescue (or foster) any more elderly Great Danes because I have no idea where we will live if we lose the house.

And so we wait. We wait on a court system that is overburdened and backlogged. We wait with a sword dangling over our heads. Our parents never could have imagined what we are going thru for the gift they gave us out of love.

In an attempt to stay positive, we did finally repaint the house. After all, paint is cheaper than therapy!

We have decided that we must live with a little bit of hope. And we hope we keep our home.

Our thanks go out to everyone who has expressed concern. We welcome your thoughts.

Amanda is best reached via text or Facebook.

Just a little update as of April 26, 2024...a visitor to this website (and a customer) suggested that we contact Senator Jeanne Shaheen and Senator Maggie Hassan, as well as the Attorney General's Office.

I did that, with mixed results.

Senator Shaheen's office responded quickly and with a kindness that surprised us, but they are unable to help. Maggie Hassan's office has not responded. The Attorney General's Office responded but could not help...however they did suggest three different agencies that might be able to do something. I contacted all three and NONE of them could do anything. One could not assist because although "The Bank" does business in NH, they are an international entity and therefore untouchable. (OK, I am paraphrasing a little there. But that was the gist of their response.) The other agency could not help because "The Bank" has "assets in excess of 10 billion dollars", which apparently also puts them out of the reach of any action by that agency. The third agency would not help because a decision is still pending. Fair enough.

It has also been suggested that I contact a Massachussetts senator who has really gone after the business tactics of this bank in her state. I tried that, but her office quickly informed me that she can do nothing because I am not a Massachusetts resident.

AN UPDATE FOR 2025!

After a solid year of waiting, we did get a decision from the Superior Court...and it was resoundingly in our favor!

Unfortunately, the Bank immediately objected and filed an appeal, which means Amanda and I are still embroiled in this never-ending nightmare...

and we get to go to court AGAIN to fight for our home.

This time we go to the Supreme Court. I found a new attorney who specializes in appeals, and he has written a rock star brief on our behalf.

It was filed with the Supreme Court on March 15, 2025, and now we wait for our court date.

Additionally, while researching the issue, our current lawyer discovered that the Bank actually DID fix the mistake (way back in 2017) when our Dad asked them to do it. But they did it WITHOUT TELLING HIM. The space on the paperwork for his required signature is BLANK. Dad would not have been overly concerned about that...all he needed was a phone call saying "Hey Les, it is fixed".

But the Bank could not be bothered. And so Dad had initiated the court process to force them to make the changes that had already been made....without telling him. He never knew.

Making changes to mortgage documents without informing the MORTGAGEE is ILLEGAL. Yes, Les requested the correction...but they are required to at least TELL him it was done and have him put ONE single signature on the paperwork. They did not.

They made an illegal change on mortgage paperwork....and stayed silent about it.

You may be visiting our website primarily to find out if we will be open for 2025.

The short answer is no. We still have a long fight ahead of us. And IF we win, we will need to do quite a bit of work on the daylily field before we reopen, including an all-new irrigation system and a total rebuild of the well. Probably a new pump, too. We have held off on doing this work because it is a lot of physical labor and expense...and if we lose the house we lose the daylilies. It makes no sense to do all that digging and buy all that new PVC....and then hand it over to the Bank.